Micro, Small and Medium-Scale Enterprises (MSMEs) are the backbone of Ghana’s economy. Startups and MSMEs account for no less than 90% of companies and create about 60% jobs in the formal sector in Africa. In terms of wealth creation, they generate an average of 40% to 60% of the Gross Domestic Product (GDP) of African countries. However, MSMEs’ face many difficulties and challenges including access to appropriate sources of financing and access to guidance.

In this regard, the French Embassy, in partnership with Proparco – Groupe Agence Française de Développement (AFD), Ghana Investment Promotion Centre (GIPC), French Chamber of Commerce and Industry (CCIF Ghana), and Innohub has organized a Speed Dating Event under the French Government’s Choose Africa Initiative to connect MSMEs, Start-ups, and entrepreneurs with Proparco’s partners, and to meet with investors, bankers, and key players of the MSMEs’ ecosystem in Ghana.

The event, which took place at the Labadi Beach Hotel, among other things, was aimed at helping MSMEs understand the network, processes and actors dedicated to them; learn the best practice to pitch their projects to investors and especially to better appreciate the fundraising process.

The occasion was graced by Her Excellency Anne Sophie AVÉ, Ambassador of France to Ghana, Mr. Yofi Grant, CEO of the Ghana Investment Promotion Centre (GIPC), Madam Fatoumata Sissoko-Sy, Proparco’s Regional Director for West Africa, Dr. Christophe Cottet, Country Director for Agence Française de Développement (AFD), Mr. Ange Pascal KOUASSI, Proparco’s Country Representative for Ghana, Mr. Nelson Amo, CEO of Innohub, and a Representative on behalf of Honourable Alan kyerematen, Ghana’s Minister for Trade and Industry.

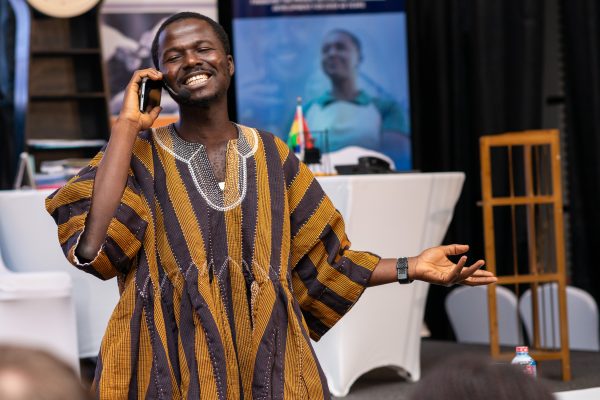

Side attraction to the event was the hilarious Live mini dramas produced by Globe Productions that showcased the common scenarios of entrepreneurs and MSMEs with raising funds from Venture Capital and Private Equity funds vis a vis raising debt financing from banks.

Participating MSMEs also g0t the opportunity to pitch their businesses and projects to Venture Capital and Private Equity Funds, namely; Wangara Green Ventures, Yaro Capital, Verod Capital, Investisseurs & Partenaires (I & P), and Oasis Capital Ghana, as well as the Banks present including; FNB Ghana, ECOBANK, Fidelity Bank, Access Bank, Société Générale, and Micro-Finance institution, the Advans Group.